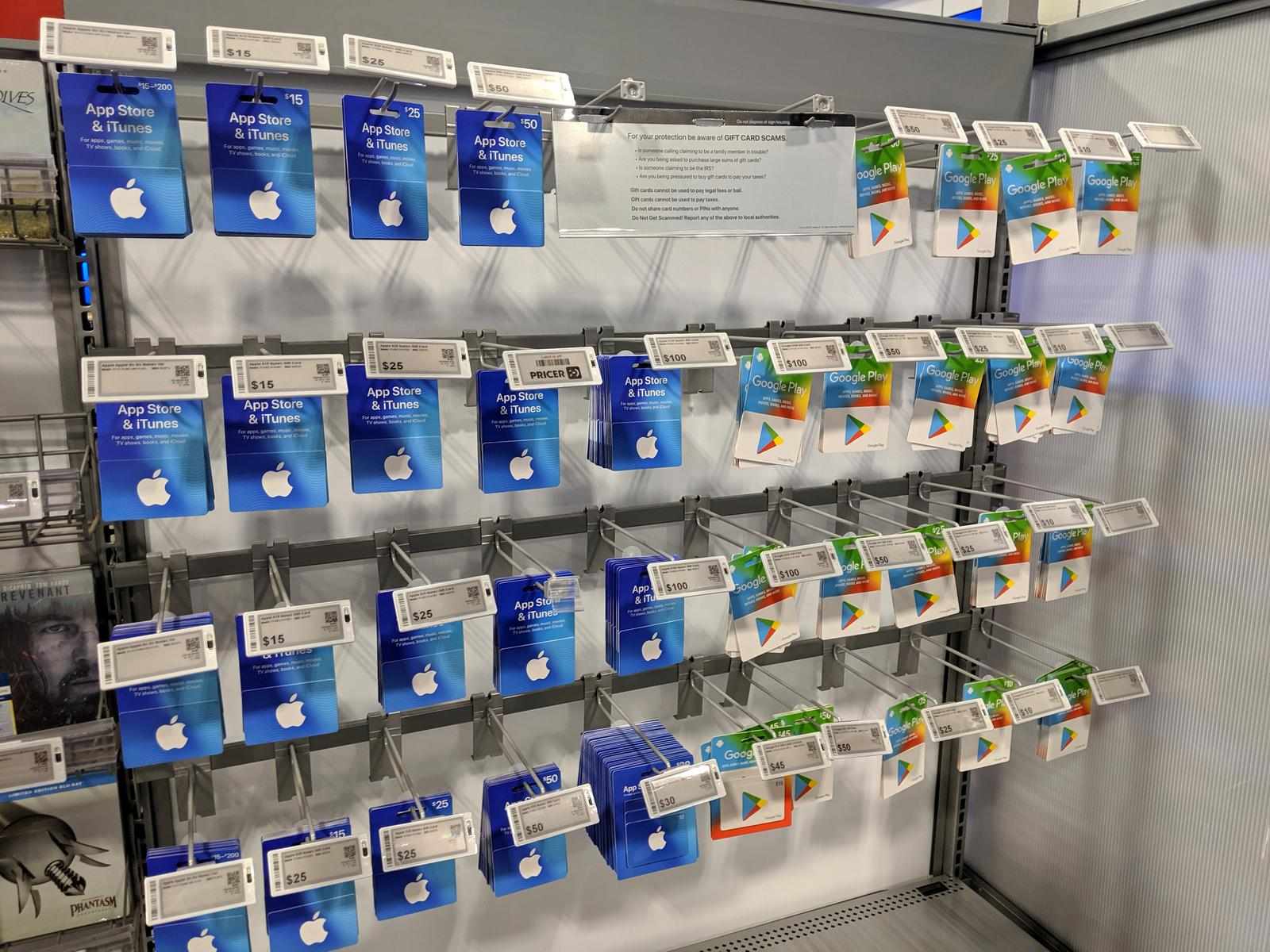

In today's fast-paced consumer landscape, gift cards have become a ubiquitous offering, designed to simplify the gifting process. Whether it's a birthday, holiday, or merely an appreciation gesture, a gift card seems to be the go-to option for many. But like most financial products, gift cards come with their own set of advantages and disadvantages. Understanding the pros, cons, and financial implications can empower consumers to make more informed decisions.

Pros of Gift Cards:

- Flexibility for the Recipient: Unlike specific gifts, which can sometimes miss the mark, gift cards offer recipients the freedom to choose their own gift. This ensures that the money spent doesn't go to waste on an unwanted item.

- Convenience: Gift cards are compact, easy to purchase, and can be sent electronically, eliminating the need for wrapping or shipping. They are perfect for last-minute gifts or for loved ones who live far away.

- Budgeting Tool: For individuals who struggle with impulse spending, store-specific gift cards can act as a self-imposed limit. They can load a specific amount on the card, thereby only spending what's available.

- Promotions and Rewards: Retailers often have promotions where purchasing a gift card can lead to additional rewards, either for the buyer or the recipient. This can increase the overall value of the gift.

Cons of Gift Cards:

- Expiry Dates: Some gift cards come with expiration dates. If not used within the specified period, the card becomes useless, and the money goes to waste.

- Loss of Value Over Time: Some cards have fees associated with them, especially if they aren't used promptly. Over time, the actual value of the gift card can decrease.

- Limited Use: Store-specific gift cards can only be used at that particular store, limiting where the recipient can shop. Additionally, if the store goes out of business, the gift card may become invalid.

- Impersonal Touch: While they offer convenience, gift cards can sometimes come across as impersonal, suggesting a lack of thought or effort in the gifting process.

Financial Implications for Consumers:

- Breakage: A significant percentage of gift cards are never fully redeemed, a phenomenon known as 'breakage.' This can lead to consumers losing out on the full value of the card. According to some estimates, billions of dollars go unspent on gift cards each year.

- Upselling and Overspending: Retailers are keenly aware that gift card holders often spend more than the value of the card. This can lead to unplanned purchases and overspending, which can impact a consumer's budget.

- Gift Card Fraud: As with many financial instruments, gift cards are susceptible to fraud. Scammers have developed various methods to drain the funds from these cards, leaving the intended recipient with nothing. It's essential to purchase from reputable sources and be wary of deals that seem too good to be true.

- Secondary Market Implications: There exists a secondary market for gift cards, where consumers can buy or sell their unwanted cards. While this can be an advantage for those looking to convert an unwanted gift card to cash, there are risks involved. The cards sold might be fraudulent, have less value than stated, or expire soon. It's crucial to approach these platforms with caution.

Gift cards are a convenient and popular method of gifting, but it's essential to understand the full picture. While they offer flexibility and can sometimes come with added benefits, there are pitfalls and financial implications to be aware of. By being informed, consumers can maximize the benefits while minimizing the drawbacks. The key lies in knowing when and how to use these cards and ensuring that the recipient can make the most out of this modern-age gift.